#26: What Does This Week's U.S. Congress Bill Mean For The Climate, And Investing In A Clean Energy Future?

The U.S. Congress just passed a meaningful piece of climate legislation. Hurray! Because it was unexpected, investors need to get thinking on its implications.

PRESSED FOR TIME?

The $369 billion climate and tax bill from Sen. Joe Manchin and Senate Majority Leader Chuck Schumer caught everyone by surprise. The fact many climate watchers expected a major piece of policy to be a pipe dream in this Presidential term now means the investment community is scrambling to pore over the bill and its implications. This issue dives into some of those questions.

I DON’T FOLLOW U.S. POLITICS, WHAT JUST HAPPENED?

If you don’t follow American politics — either for health reasons or because you live far, far away — there’s been a big development in the world of climate policy.

In a late July surprise, Senate Majority leader Chuck Schumer (D-New York) and pivotal swing vote Joe Manchin (D-West Virginia) came together to announce the Inflation Reduction Act (IRA). It’s a big piece of work touching on many areas of American life from healthcare to tax, but we’re focusing on climate. Overall, the bill will make clean energy cheaper and build up the capacity of industries in the U.S. and its allies across multiple sectors of the economy — including power, transportation, heavy industry and buildings. But we’re talking about sectors that run into the billions and trillions, so the devil is in the detail.

IS THIS BILL A BIG DEAL?

I’ve been asked this a number of times already, especially when many wise and respected climate voices on cable news and social media are lamenting the paltry size of this bill, relative to say 5% of the annual U.S national security budget.

My answer: yes, the bill’s a big deal. We won’t likely know for a decade how much it stimulated. Firstly, the numbers from an emissions perspective. The excellent team led by Jesse Jenkins over at the REPEAT project have modelled the reduction in record time. If you squint and look at the purple and green lines below, you’ll see this isn’t far off what the Biden Administration wanted in the very beginning:

WHAT IS THE BILL DOING?

In a 700-page piece of legislation that many who even voted for it don’t read, it helps to distil the effects of this bill down to a single, coherent idea:

This legislation makes clean energy cheap.

What do I mean by this? It subsidises through grants, rebates, tax credits, loan programmes, loan guarantees, and most importantly a really robust package of tax incentives that touch every major emitting sector of the economy.

The IRA effectively reduces the excuses for any business leader, household or other private entity to consider the cleanest possible energy for their needs, because honestly, it’s going to be cheaper than fossil fuel alternatives and better economic sense.

What hasn’t been modelled in a lot of the recent report releases is the extent to which this bill is likely to spur regulatory agencies, and state and local governments to expand their ambitions and emissions reduction targets. Cities or companies who had a 35% emissions reduction by 2030 will now find a 50% or greater reduction achievable just through the amount of clean energy coming into the system. This is the big unknown, in a good way.

TAX SECTION: PLEASE BE PATIENT...

Many of the tax code provisions also provide two credit values: a lower base credit and a bonus rate. The bonus rate is equal to five times the base amount, and is available only when requirements related to prevailing wage and apprenticeship are met.

What is this legal-speak for? Good paying American jobs, onshore and in clean energy. There is now a big tax incentive to generate a clean energy economy domestically.

The other key area is in the tax treatment of energy generation. Until now, two schemes did the bulk of the heavy lifting for anyone wanting to invest in a solar or wind farm: the Production Tax Credit (PTC), and Investment Tax Credit (ITC).

The PTC and ITC will transition to technology-neutral in 2025.

Why is this a big deal?

The tax regime is no longer interested in (indirectly) picking technology winners. Whatever the energy generation, transmission or storage method, there’ll be tax relief on offer.

Even if you’re still in the solar or wind business, there’s tax credits falling out of Santa’s red sack. There’s credits if you build in a low-income community. There’s credits if you build in a region coming out of redundant fossil-fuel economies (i.e. coal or oil towns). There’s credits if materials for the wind turbines or solar arrays are made on American soil. AND if you build in a low income, legacy coal community with U.S. made steel, concrete and aluminium, and a majority of the manufactured parts are domestic, and you pay solid middle class wages to the workforce, the credits pile up in the double digits to create a highly lucrative project.

OK, THIS MAKING STUFF IN AMERICA THING IS INTERESTING..

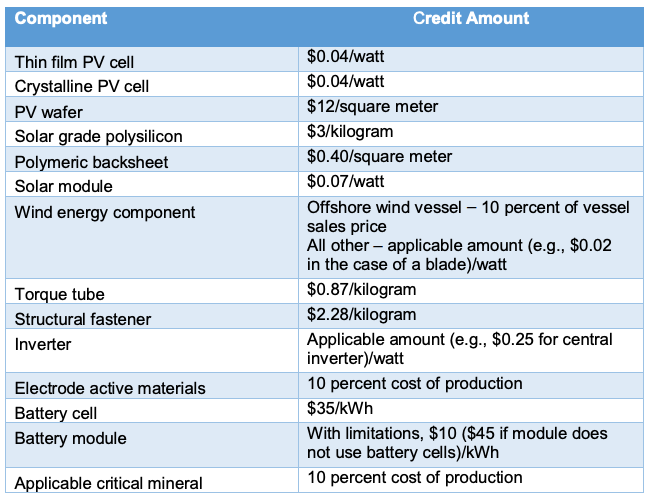

It really is, and will add up fast. The IRA will also create a new production credit through to 2032 for the production of components related to clean energy such as solar photovoltaic (PV) cells, wind energy components and battery cells.

You’re going to hear a lot more about America making stuff again. Similar credit tables exist for carbon sequestration, clean hydrogen, sustainable aviation fuel, biodiesel, buildings, new vehicles, the list goes on. Each of these categories could be a newsletter in its own right (some are in the works), but for now a helpful explainer can be found here if you are interested in each provision.

I’M THINKING OF BUYING AN EV (OR OWN EV STOCKS), WHAT DOES THIS BILL DO?

Until now, a $7,500 tax credit for the purchase of a new electric vehicle (or plug-in hybrid with a large enough battery) was on offer, if you were in the first 200,000 vehicles the manufacturer made. Tesla had blown through the cap. Ford had as well. Nissan, Hyundai and GM were getting close. The current policy was that’s it. This bill now introduces two credits for new EVs, totalling up to $7,500 per car. A new electric vehicle can qualify for a credit of $3,750, provided it meets certain conditions: its final assembly must take place in North America; it must cost under $55,000 ($80,000 for pickups or SUVs); and buyers must have annual income of less than $150,000 (more if they are married or heads of household). The market will move to accommodate these changes in quick time, no doubt.

But let’s consider business vehicles. A purchase of an electric or fuel cell vehicle creates a 30% investment tax credit by any business. If you are Amazon, and thinking about electrifying your delivery fleet, or if you’re Enterprise or Avis and buying your hire car fleet, electric just got a whole lot cheaper. For all of us that means driving a lot more EVs in rental contexts, and that means us all getting much more comfortable with the experience as we go to buy them ourselves in future purchase cycles.

COULD THIS BILL BE DERAILED?

Because the IRA has a decade-long timespan, the risk remains that changes in administration could slow climate investment. Still, since this is a congressional act—not an executive order—it will require legislative or judicial action to undo, thus making it harder to reverse. In addition, courts will likely be less sympathetic to any claims that federal rule-making pursuant to the bill violates the major questions doctrine recently articulated by the Supreme Court in West Virginia v. Environmental Protection Agency (EPA), and covered in a recent newsletter.

In short: it’s possible but undoing initiatives like a $27 billion green bank is difficult when the business community will want the certainty of its continuation. I suspect a lot of the package is here for good.

OK BUT I’M AN INVESTOR, WHAT DOES ALL MEAN FOR ME?

A retail or even sophisticated investor should start with a question for every firm, every stock, every supply chain and business model going around —

To what extent does the firm need to decarbonise (relative to the rest of the economy), and what will they need to spend to do this?

Then they should be asking the following questions:

The IRA drives a lot of investment in supply chains. If I pull out a map of the country, where is this likely to benefit?

Where have coal mines and coal plants closed in the last ten years? Does any legacy infrastructure exist for a natural transition to new types of technologies?

What is the topography of each market? Solar, wind, next generation nuclear isn’t always easy to build on a mountain side. Transmission routing also isn’t easy over hard to access terrain.

What states is it easy to build? What are the permitting timelines?

If the best projects will be developed close to the existing energy grid, where does that favour?

Which firms had energy transition plans already in place that could now see unforeseen returns?

Which firms make big announcements in the coming months on a large carbon capture initiative or plant refurbishment? Hint: they likely had a borderline investment case that has now been pushed over the edge with the credits on offer.

Which firms have a transport component that can benefit from cheaper EVs? Which firms can’t benefit because of immovable constraints?

Bottom line: if you’re in a bar tonight trying to explain to someone what the IRA is going to achieve in climate policy, I would say this:

The IRA establishes financial incentives across the economy, so that it now makes good business sense for firms to invest at the pace and scale of clean energy deployment needed. In other words, there’s a lot of money to be made by hitting the 2030 and 2050 emissions reduction targets.

There’s other work than needs to be done, and Biden’s 50% emission reduction by 2030 pledge has not been met, but in light of world events, and the politics of the day, it’s a big step forward and grounds for plenty of.. optimism.

Optimistically,

Owen C. Woolcock

3 Questions I Am Asking Myself This Week

1. 40cm..!

2. Though not covered in this issue, methane is worth watching:

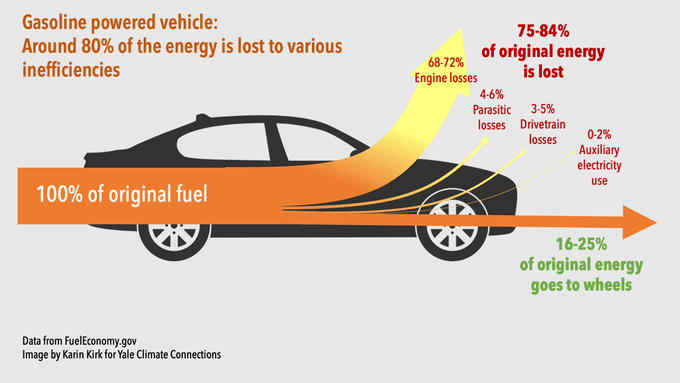

3. Deciding on an old ICE car or EV for your next family vehicle purchase? Consider the facts in this excellent graphic from the team at Yale Climate Connections:

If You Read Or Listen To One Thing This Week

The REPEAT Project’s excellent overview of the bill modelling is well worth a look.