#1: Welcome.

Let's Think, Analyse and Question Together

PRESSED FOR TIME?

This is a newsletter for those who think about a changing climate’s impact on the money in your pocket today, tomorrow and a generation from now. It won’t preach. It will ask good questions, and give you plenty to think about. Subscribe. It’s FREE.

MISSION STATEMENT

Risk is everywhere. Much of our economy has been built around containing risk — we design the built environment to specific resiliency standards, while actuaries, catastrophe modellers and other quants put a price on risk for nearly every dollar deployed. To price risk accordingly, we need to understand it.

It isn’t climate change — it’s everything change.

To quote Margaret Atwood: ‘it isn’t climate change, it’s everything change.’ A changing climate changes everything. Risk pricing might have happened for the climate in small cases — like stochastic hurricane models for a global reinsurer — but it hasn’t flowed through to the rest of the capital and money markets, nor the ways each of us access mortgage or credit card debt. Exposure is everywhere. A lot of hurt is coming if large and small investors don’t educate themselves.

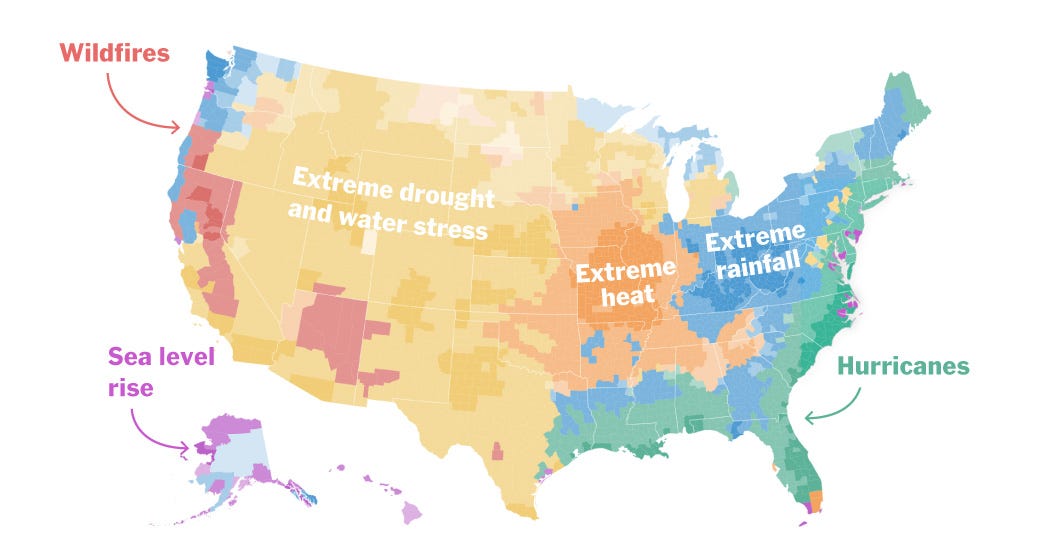

Source: NYT Climate Lab

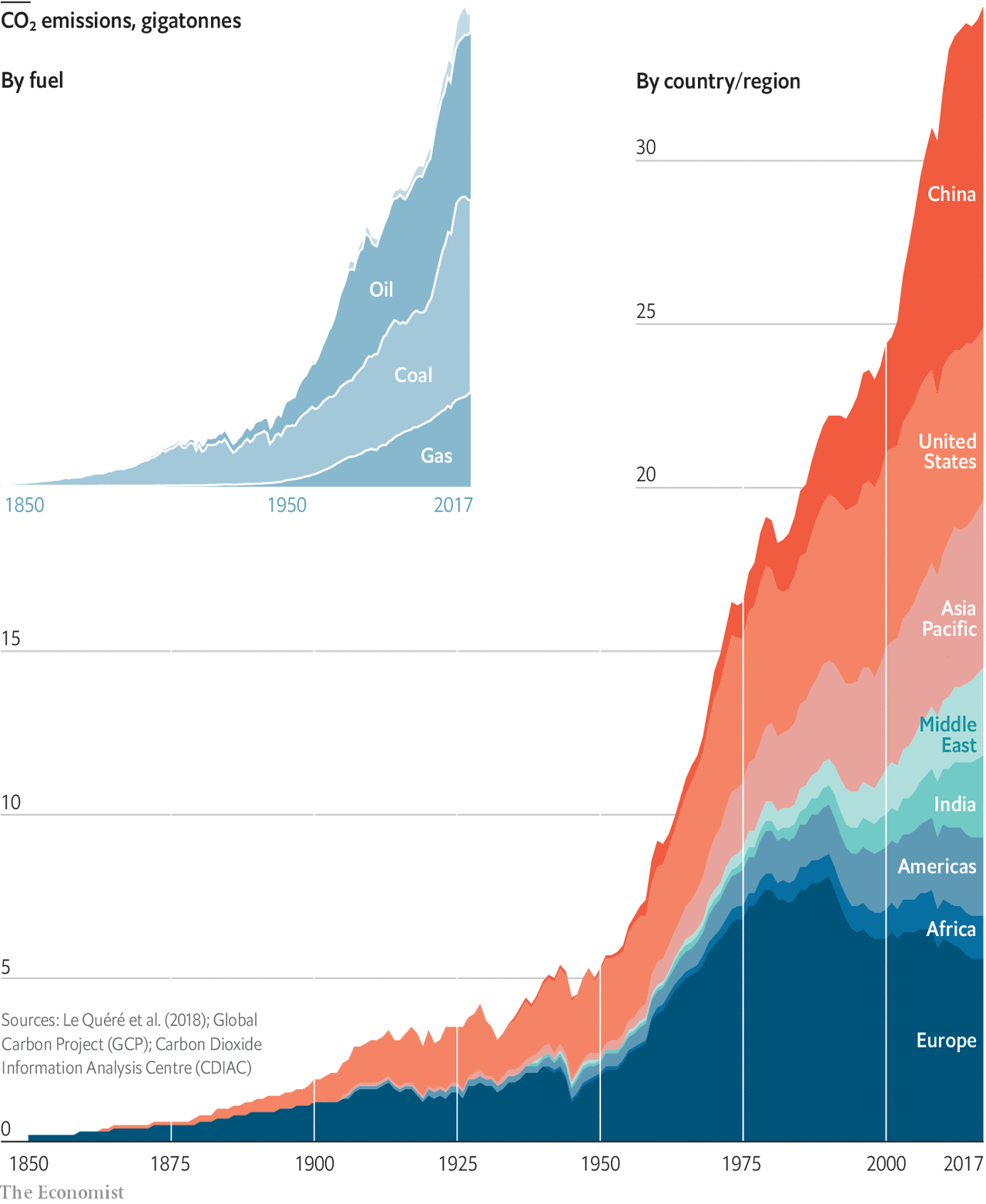

The dirty little secret is valuation — or the expected value of future cash flows on a given asset — is lagging behind risk recognition. Most of the things we value in our economy, we do so based on the presumption of a stable climate. To now, financial markets have simply left a changing climate outside of much of their modelling and forecasting. Climate change isn’t easy, because it’s open ended risk. But we should think about it more and attempt to price it better.

This newsletter is for people who want this type of thinking in their mental model.

At Harvard University, I spend 60+ hours per week reading, discussing and synthesising these questions for my own research.

Every second Friday morning, I will share my learnings from the academic papers, investment events, classes, guest lectures and private conversations I have with scholars, colleagues and asset managers around the world.

I want to be part of a quantum leap in education, and will share what I learn. All you have to do is subscribe.

Talking about our climate is hard. Climate change is not linear, uniform or stationary; it requires overlapping choices for price-setters and price-takers in the economy. Even if rising average temperatures are curbed, multiple feedback loops have begun and will take many decades and centuries to unwind. As the climate transitions from a period of relative stability to increasing instability, it will mean asset revaluation, disrupted cash flows and new lending conditions for millions, irrespective of the timeline of mitigation. In subtle ways this will impact company valuations, insurance prices, assets, loans and retirement plans.

We have effectively conducted business on our planet for 150 years a certain way, and need to rapidly change course in a generation. Winners and losers will litter the economy for the rest of our lifetime.

INTRODUCING CLIMATE AND MONEY

This project is called ‘Climate and Money’ because two audiences — climate science, and ordinary people with relationships to the markets — need to understand the other’s language, outlook and incentives.

Several important ideas are not often said, uncomfortable to hear, but important to understand.

People will profit from working on the climate response. Our goal should NOT be to find excess profits from the climate crisis, but we shouldn’t seek to punish or demonise those who create products, services and asset classes that accelerate the decarbonisation, consumer changes and population realignment we need to see.

The sooner capital markets price in a changing climate, the better the climate response will be. Even the most ardent environmentalist needs to accept investment, subsidy and government transfer involves money, and as a result, large sums of money will be put to work with varying philosophical objectives — finding the ‘green premium’ will be one of them. Equally the most ardent free-market capitalist needs to acknowledge things we presently don’t value in monetary terms (i.e. wetlands, mangroves, indigenous fire management techniques) have enduring value that we need to understand, manage and preserve.

When responding to climate change, the market will produce unintended consequences. It always has, we shouldn’t expect different on such an enormous project. Delving into those with an open mind is a helpful contribution.

It is OK to accept the science on climate change, support action on mitigation and adaptation, and still worry about how these large societal changes will affect YOU. Government action will inform markets, and market actions will affect everything — our investments, earnings, retirement and the living standards of our children.

If you think the looming economic transformation around climate change isn’t priced well into markets, then you should subscribe and we’ll think on that together.

If you think this information could be found elsewhere, then subscribe for two months and go with my blessing if you get no value from it. If you are receiving this without having actively subscribed, then you are a friend or colleague who I would love supported this from the outset with an agreement to receive just one Friday morning email every two weeks.

Lastly, this project is about respectful inquiry. The internet has become an unpleasant place. I want to think, analyse and question like I’m with friends around a camp fire.

Subscribe. It’s free. We need to think harder and better, so let’s do it together.

Optimistically,

Owen C. Woolcock

3 Questions I Am Asking Myself This Week

1. Who benefits if a US-wide carbon price is in place by 2024?

2. If free college tuition was first extended to STEM degrees with explicit climate mitigation pathways after graduation, what outcomes would this incentive stimulate? What if it were branded as a national security talent pipeline like the Apollo Missions? How would the public react to such a policy?

3. What becomes of all the pre-2000, non-antique automotive vehicles when developed economies in North America and the EU decide they are too dirty to keep on the roads?

If You Read Or Listen To One Thing This Week

Conversations with Tyler (Episode 93): Philip Tetlock on forecasting — an excellent discussion on forecasting, and thinking like someone who predicts with better accuracy than most of us.